Third Sector Forecast 2019

The sector continues to face the twin challenges of increasing demand against a backdrop of funding challenges, particularly shrinking public sector budgets and the direct and knock-on effect of local authority cuts on voluntary organisations and the communities they work in.

Last 12 months

There has been an increase in number of people reporting having had a difficult year (23% in 2018, up from 17% in 2016). Medium-sized organisations are most likely to have had a difficult year. More positively though, there has been a small increase in the number of organisations reporting that they grew in the last year.

Next 12 months

For many charities and community groups the forecast for 2019 remains ‘unsettled’.

Respondents are very concerned about the overall financial picture – for the third sector, the public sector and Scottish economy as a whole. 34% think their own organisation’s financial situation will deteriorate. 75% think that the financial situation for the sector will worsen, and 82% are worried about the challenges created by funding cuts. 81% of respondents expect demand to increase, up from 72% in 2017.

Those with paid staff are particularly concerned about increasing workloads, static pay and job insecurity.

Despite the challenging environment, we are still seeing energy and vision in the sector. Confidence is only down slightly on previous years.

This year respondents are still worried about the many challenges facing the sector, and optimism levels are about the same. Planning is even more difficult in today’s uncertain political and financial environment – 91% of organisations told us that planning for the future is a challenge. Funding cuts and competition for funds mean that the trend of surviving not thriving continues for many.

But respondents in the main are looking at constructive ways to deal with the challenges ahead. Two years ago there was a drop in the number of activities and services planned for the year ahead, with organisations withdrawing into their core services and adopting a ‘survival mode’ approach.

This year respondents opportunities: to grow and meet increased demand; to promote their services; to work with young people, employability, health and mental health; to source new grants; to develop trading and enterprise; to tell more people about the great work they do. Our sector seems more upbeat about trying to rise to the challenges - looking for new ways to support people and improve what they do even as budgets tighten.

Looking forward

- People expect tough times ahead. 34% think their own finances will worsen, and 75% think that the financial situation for the sector will worsen.

- 88% of respondents from rural areas believe the sector’s financial situation will worsen.

- There continues to be a great deal of uncertainty around funding and political environment.

- 1 in 4 don’t feel confident planning ahead for the coming year.

- Despite this, confidence is only slightly down on two years ago.

- Sector is trying to rise to challenges and be proactive.

- 56% of respondents think that the number of services they provide will increase.

- 81% of respondents expect demand to increase – up from 72% in 2017.

- Only 1% anticipate a drop in demand.

- Only 9% think that the number of services they provide will decrease.

Key issues

- 100% of respondents are concerned about rising overheads.

- 91% of respondents said planning for the future is a challenge.

- 91% of respondents said sourcing long-term funding is a challenge

- 88% of respondents said diversifying funding is a challenge

- 82% of respondents are worried about the challenges created by funding cuts

- 81% of respondents said meeting increased demand will be a challenge

- 83% of respondents think delivering quality, affordable services will be a challenge

- 84% of respondents think demonstrating impact will be a challenge

- 80% think managing relationships with local and national government will be a challenge

- 67% of respondents think recruiting and retaining staff will be a challenge

- 67% think recruiting and retaining volunteers will be a challenge

Opportunities and challenges

The key challenges cited by respondents were primarily concerned with meeting increased demand at a time when the funding environment is increasingly difficult. Many highlighted that statutory cuts were adding to already high workloads:

“Funding cuts are going to continue to be an issue as they hit the third sector across the board and when statutory services are also cut this also impacts on the third sector as the demand for our services increase”

However, many spoke about the opportunities that increased demand offered, and were looking to rise to the challenge by building relationships, collaborating, identifying new funding opportunities, demonstrating impact and building on their reputation as valued partners:

“We are punching well above our weight, which is exponentially increasing our profile and reputation and the trust that our stakeholders have in us. We remain very optimistic about new opportunities opening up, albeit in a climate of continuing uncertainty and financial challenge.”

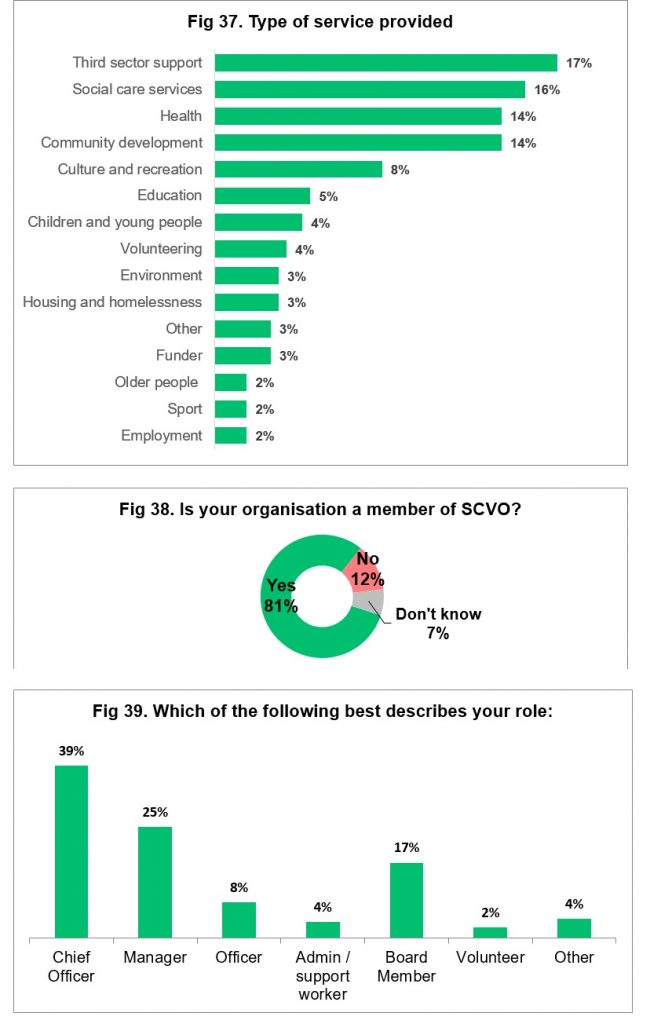

1. About the survey

The survey was open from 21 November 2018 to 9 January 2019, and distributed through a range of channels including SCVO members’ bulletin, via social media, and the Third Force News website. The survey was completed by 318 respondents.

2. The last 12 months

Respondents were asked how they had fared over the last year.

Good year, bad year?

- Over a third of respondents (39%) reported having had a good year, but this is down from 47% in 2017.

- 23% of respondents reported having had a difficult year, up from 17% in 2017.

- Smaller organisations appear to have had a better year than larger organisations – this may be because they are less reliant on competitive funding and less vulnerable to large funding cuts, and instead have become adept at managing to tick over with low levels of funding.

- Medium-large organisations (£101k-£1m) were most likely to have had a difficult year, with 26% saying they’d had a difficult year, up from 19% in 2016.

- We are also seeing the number of larger over £1m turnover organisations reporting having had a difficult year double, from 11% in 2016 to 22% in 2018.

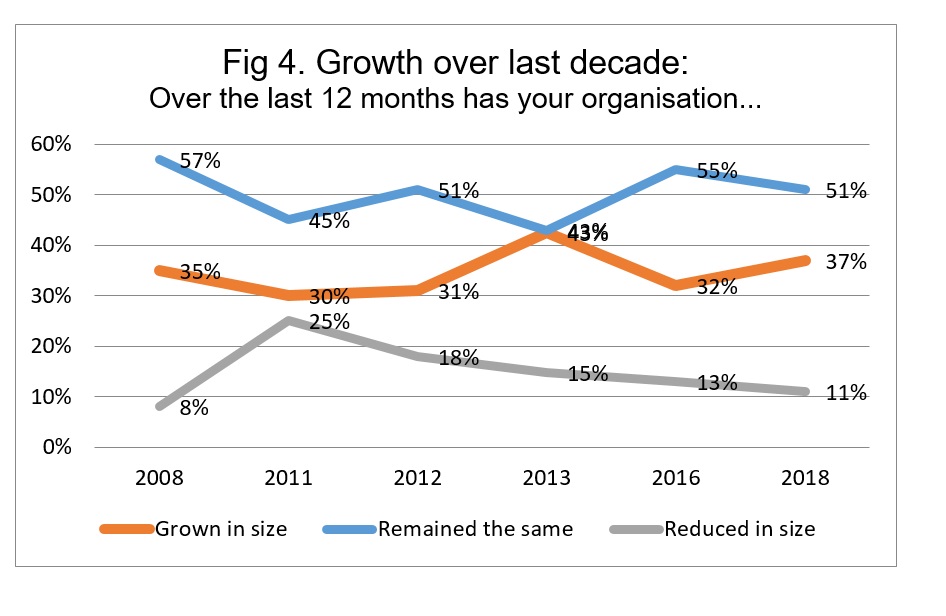

Growth over last 12 months

- Growth over last year is showing signs of improvement: 37% of respondents reported that their organisation had grown last year, up from 32%.

- 11% said that their organisation had reduced in size, down from 13%.

- Reported growth patterns are similar to those seen over the last decade:

- Larger organisations were more likely to say they had reduced in size, with 13% of all larger organisations reporting reductions (Fig 6 below).

- However, while 13% of over £1m orgs saw size reduce, nearly half (48%) saw growth.

- By contrast less than a third (30%) of medium-large orgs between £100k and £1m saw growth.

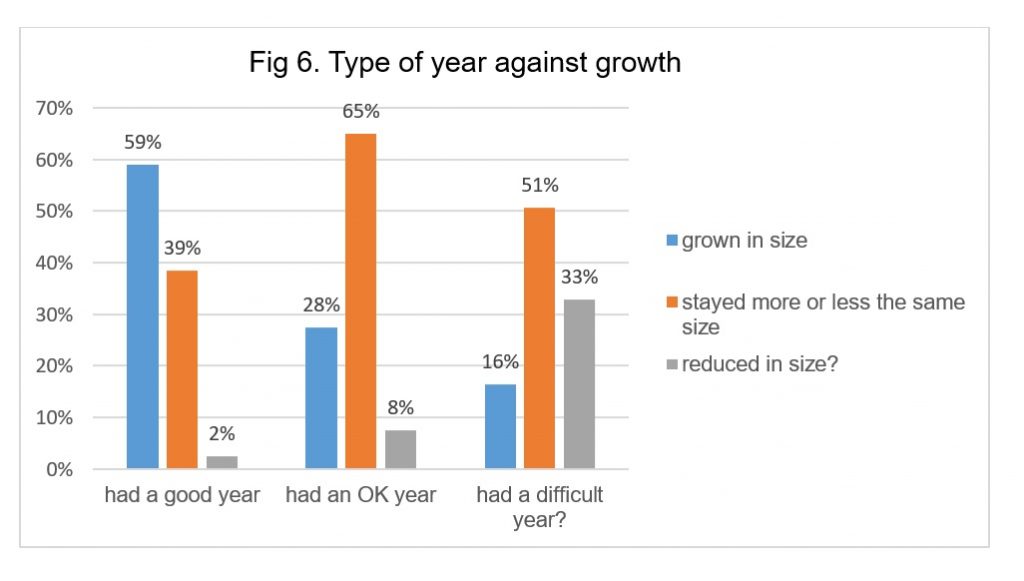

Growth and what type of year and organisation has had are not identical, but there is a strong correlation:

- Of those who have had a good year, 59% reported that they had grown, 39% have stayed the same size, and only 2% reduced in size.

- Of those who have had a difficult year, only 16% reported that they had grown, 51% stayed more or less the same size, and 33% had reduced in size.

- The majority (65%) of those who have had an OK year have remained the same size.

- Those who have grown and had an OK or difficult year are likely to have fought hard to achieve that growth.

3. Confidence

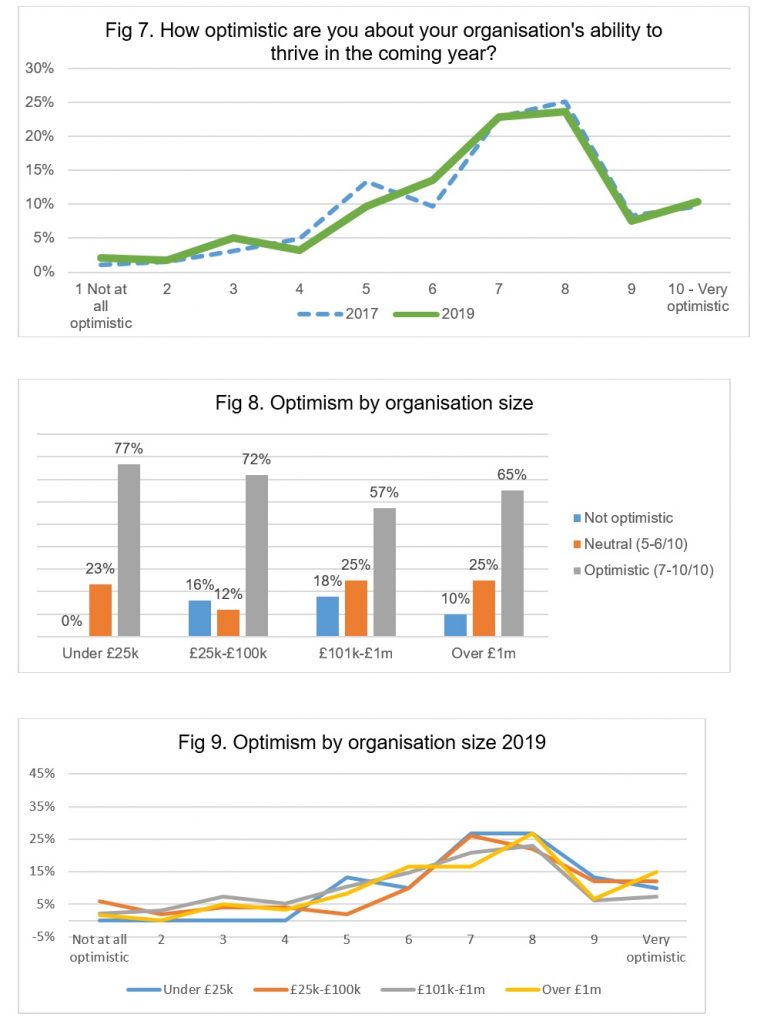

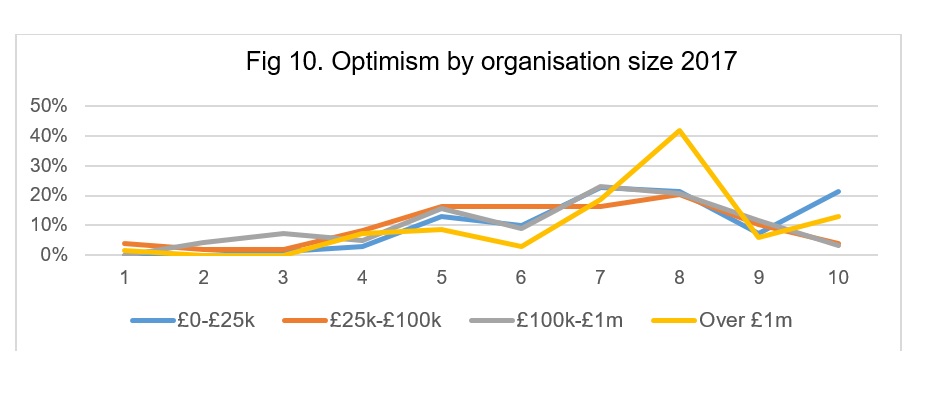

Respondents were for the most part confident about the future for their organisation, with around two-thirds saying they had a confidence level of 7 out of 10 or higher.

However, 12% of respondents were not confident about their organisation’s ability to thrive in 2019, giving scores of 4 out of 10 or lower.

Reported confidence levels are similar to two years ago.

Smaller organisations have the highest average confidence scores, perhaps because they are less reliant on fluctuating or ‘at risk’ income sources such as public sector money, and are less concerned about growth.

Medium-large sized organisations tended to have lower confidence scores than their smaller counterparts.

Larger organisations have been the one group to show a drop in optimism since surveyed 2 years ago, tracking more closely to the rest of the sector now.

More or less confident than last year?

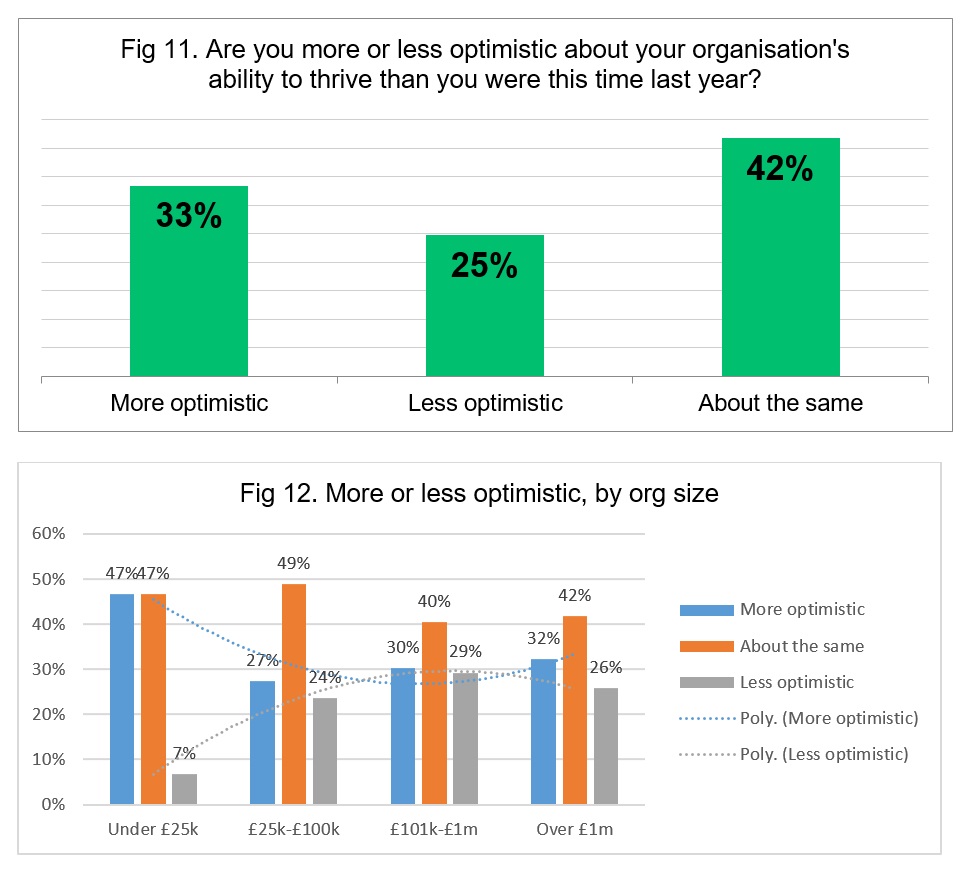

- A third of respondents (33%) were more optimistic about their future now than they were at this time last year.

- Less positively, a quarter of respondents (25%) were less confident than last year

- Organisations in the ‘squeezed middle’ – between £25k and £1m – are most likely to report that that they are less optimistic now than last year (29%), but we also see a very mixed picture in the other larger income bands.

4. The next 12 months

Demand

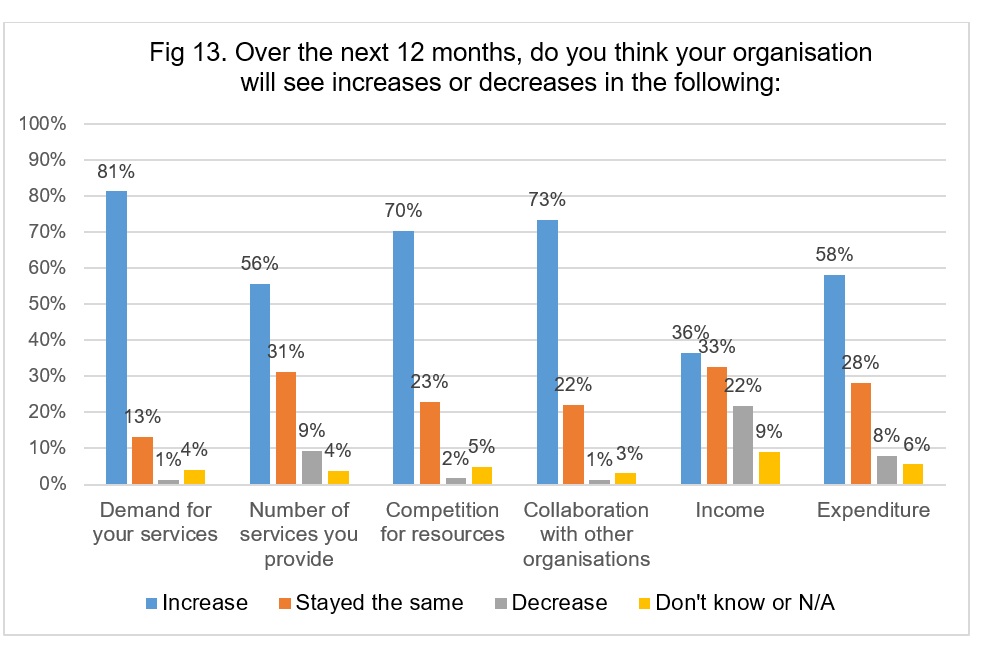

The vast majority of respondents expect that 2019 continue to see increases in demand for their services, and at an even higher level than previous years.

- 81% of respondents expect demand to increase – up from 72% in 2017.

- Only 1% anticipate a drop in demand

Number of services

- 56% of respondents think that the number of services they provide will increase

- 9% think that the number of services they provide will decrease

Competition for resources

- 70% of respondents expect competition for resources to increase (down slightly from 74%)

Collaboration

- 73% of respondents think that collaboration will increase, up from 59% in 2017.

Expenditure

- 58% of respondents think that expenditure will increase, up from 49% in 2017.

Income

- Predictions around future income show the most mixed response, with only a third thinking it will increase, a third thinking it will stay the same, a fifth expecting it to decrease, and nearly 1 in 10 not sure what will happen.

5. Financial situation over the next 12 months

Financial situation for own organisation

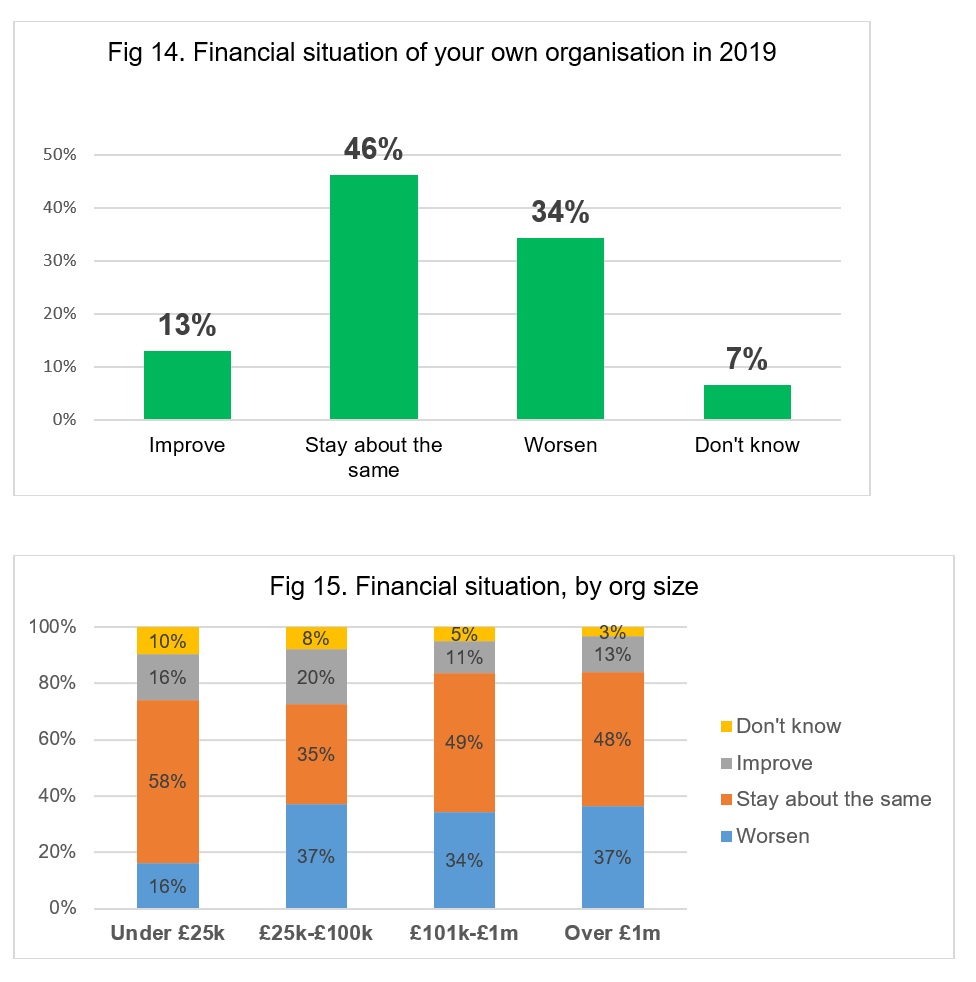

Many respondents are concerned about their own finances, with a third believing their financial situation would worsen in 2019. Nearly a half think things will stay the same. The overall figures are almost identical to those from two years ago, suggesting that for many organisations nothing has really improved.

- 34% think it will worsen (2016: 34%)

- 46% think things will stay the same (2016: 49%)

- 13% think it will improve (2016: 12%)

- 7% don’t know (2016: 4%)

- Fig 15 below shows that financial concerns are being felt across the board, with around a third of medium, medium-large, and large organisations expecting their situation to worsen.

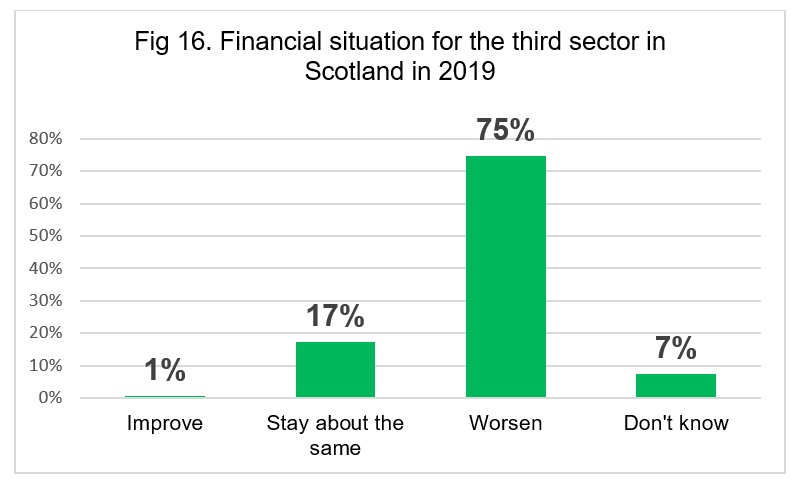

Financial situation for third sector:

Respondents were even more concerned about the general financial situation for the third sector in 2019 than they are about their own situation. Again, figures show no improvement on 2016 survey responses.

- The majority (75%) think that things will get worse (2016: 76%)

- 14% think situation will stay the same

- Only three respondents (less than 1%) thought that the sector’s financial situation would improve.

- 79% of large charities and 78% of medium sized charities think the financial situation for the third sector will worsen.

General economy

- 70% of respondents think the general economic situation in Scotland will worsen (2016: 69%)

- Only 3% of respondents thought the economic situation would improve (2016:1%)

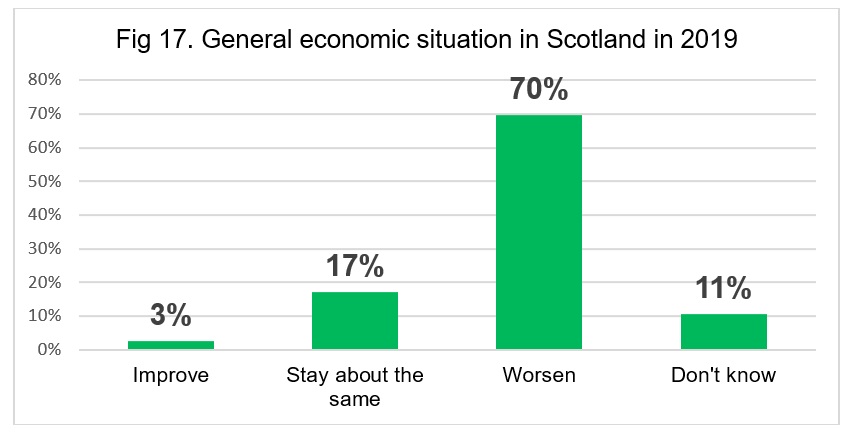

Trends over the last decade

These levels of financial concern and uncertainty continue the trend of previous years:

Note: Third Sector Stats

https://scvo.scot/projects-campaigns/i-love-charity/sector-stats

Our recent analysis of charity finances shows that the concerned predictions made in 2016 were unfortunately accurate in predicting decreased income for many charities.

- 41% of charities saw their incomes decrease in 2017

- 17% saw no real change

- 42% saw incomes increase

Happily, things turned out not quite as bleak as predicted and many did see growth.

However, while the sector did grow overall and many charities fared reasonably well, the average charity’s income grew by only 0.03% in 2017 in real terms. Despite inflation being low in recent years (2016 = 1%, 2017 = 2.6%) most charities experiencing low-level growth are really facing a loss, and a reduction in the value of their income:

6. Financial plans for 2019

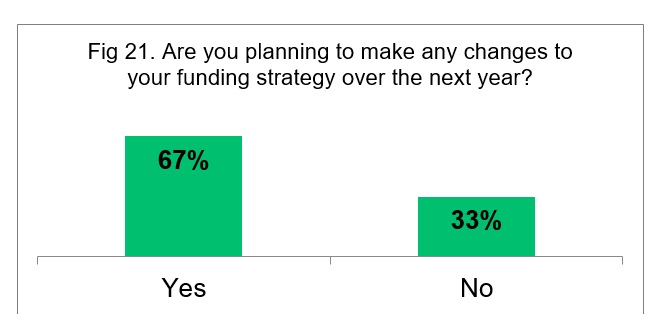

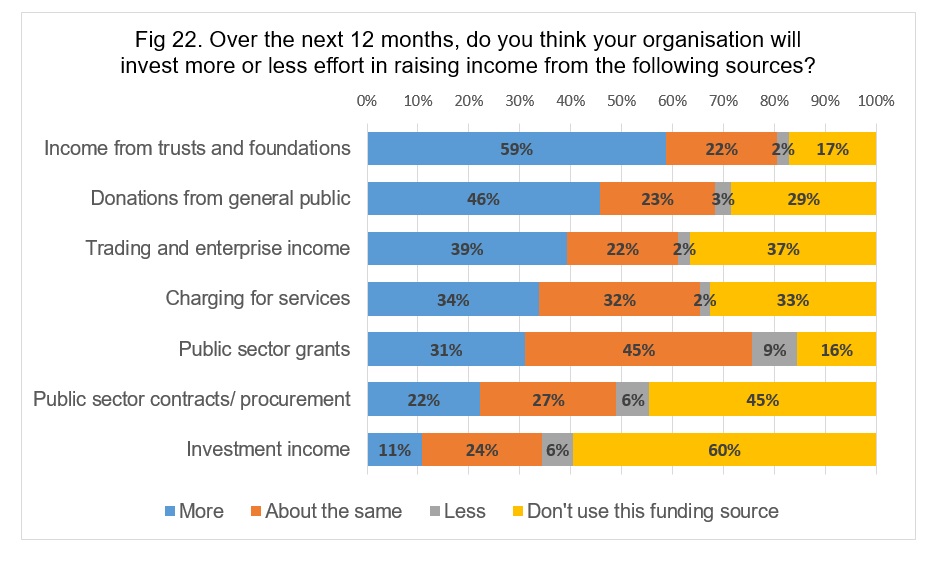

2 in 3 respondents plan to make changes to their funding strategy over the next year:

- 6 in 10 (59%) responding organisations plan to invest more effort in raising income from trust and foundations

- Nearly half of responding organisations (46%) plan to invest more effort in raising income from donations

- 2 in 5 plan to invest in trading and enterprise

- Over a third are looking at how they charge for services

- Nearly a third expect to invest more effort in sourcing public sector grants, although nearly 1 in 10 plan to spend less effort on this income source.

- 22% plan to invest more effort in public sector contracts

7. Planning for the future

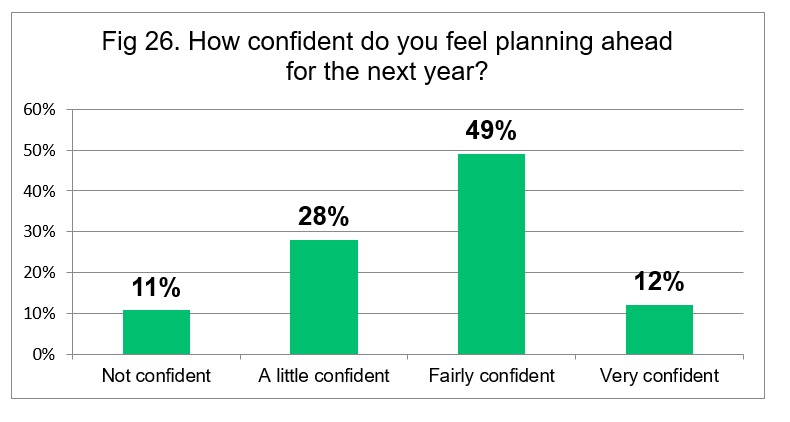

Respondents were generally feeling fairly confident about planning for the year ahead, although

- 1 in 10 (11%) do not feel confident planning ahead for the next year

- 3 in 10 (28%) are only a little confident

- 5 in 10 (49%) are fairly confident

- 1 in 10 (12%) are very confident

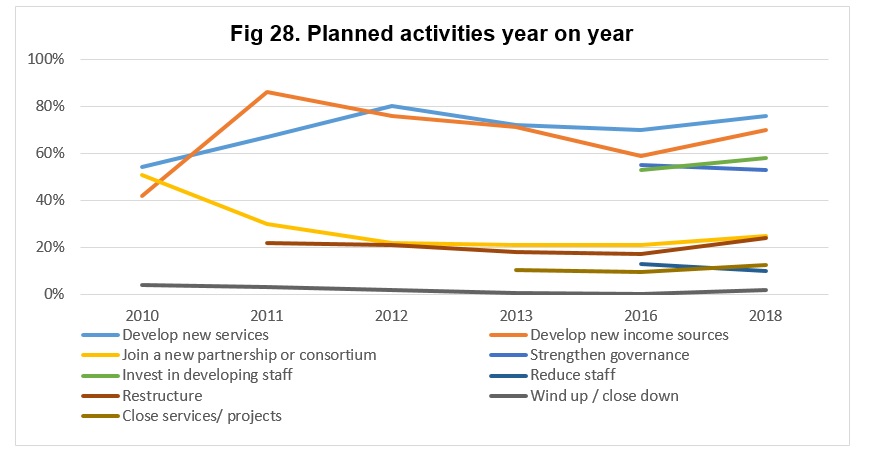

8. Planned activities

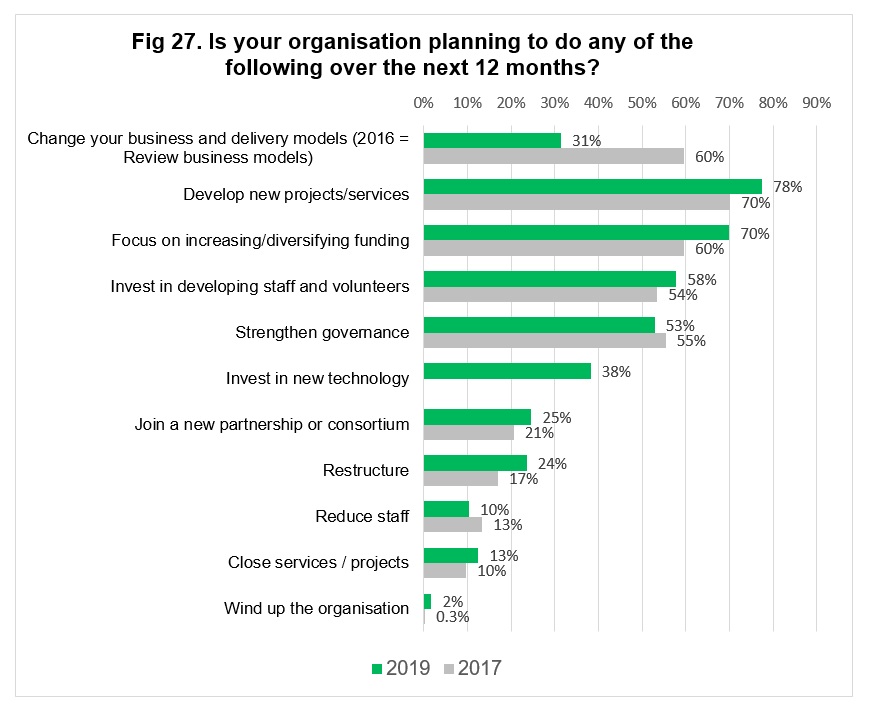

Despite the sector having clear concerns about both their own finances and the wider economic situation, most respondents report that their organisations are planning a number of activities in 2019.

The top planned activities for 2019 are all ‘positive’ actions such as:

- Nearly 4 out of 5 (78%) are planning to develop new projects and services

- 7 out of 10 are looking into diversifying funding

- 58% will be investing in staff and volunteer development

- 53% plan to strengthen their boards

A smaller number were planning ‘negative’ coping strategies for 2019:

- 13% plan to close projects or services, up from 10% in 2017

- 10% expected to see redundancies (2017: 10%)

- Only five organisation were considering winding up, but this is up from only 1 in 2017

- 24% plan to restructure, up from 17% in 2017

In 2017 we saw a sector that was more cautious than in previous years, and less able and willing to take a risk, or expand and develop new projects and services.

We are now seeing a slight upturn in proactive forward planning, with more sector organisations trying to develop and grow services and activities. Unfortunately, we are also seeing a slight upturn in the number who plan to close services or wind up.

9. Biggest challenges in coming year

- 100% (!) of respondents are concerned about rising overheads

- 91% of respondents said planning for the future is a challenge

- 91% of respondents said sourcing long-term funding is a challenge

- 88% of respondents said diversifying funding is a challenge

- 82% of respondents are worried about the challenges created by funding cuts:

55% see cuts as a key challenge and 27% as a secondary challenge

- 88% of respondents currently access some form of public sector funding (grants only: 32%, contracts only: 3%, both grants and contracts: 53%). Concerns about cuts are higher in this group – 86% of those in receipt of public sector funding are concerned about cuts, and 59% see them as a key challenge in the coming year.

- 81% of respondents think meeting increased demand will be a challenge

- 83% of respondents say delivering quality, affordable services will be a challenge

- 84% of respondents think demonstrating impact will be a challenge

- 80% think managing relationships with government will be a challenge

- 67% think recruiting and retaining staff and volunteers will be a challenge

10. Opportunities and challenges

Respondents were asked the open question “What are the big opportunities and challenges for your organisation in the longer term?”

The word cloud below shows words appearing 5 or more times in responses:

Challenges

| Table 1: Challenges cited | Count of CHALLENGES |

| Funding | 16 |

| Sustainability | 13 |

| Staffing | 10 |

| Local authority cuts | 6 |

| Demand | 6 |

| Short-term funding | 5 |

| Credibility/value of sector | 5 |

| Uncertainty / inability to plan for long term | 5 |

| Health and social care | 5 |

| Core funding | 4 |

| Cuts | 4 |

| Ageing population | 4 |

| Premises | 3 |

| Brexit | 3 |

| Public sector funding | 3 |

| Living Wage | 3 |

| Capacity | 3 |

| Poverty | 3 |

Funding, cuts and sustainability

- Issues around funding, sustainability and public sector cuts were the most common challenge cited by respondents.

- The lack of long-term funding, and inability to make plans in the longer term were also key issues.

Sample quotes:

- Funding

“Challenge is around finding funders, both statutory and other funders, who will pay the true cost of quality services delivered by skilled, qualified and experienced staff.”

- Short-term funding

“Funding, funding and more funding. No organisation with an NHS Highland Contract has any assurances whatsoever beyond July 2019, which in turn makes it enormously difficult to demonstrate sustainability to alternative funders.”

“Funding for the long term as there is little understanding of the important role we provide for older carers.”

“Year by year funding with all the attached uncertainty and management effort is still the most short-sighted public sector policy that makes life stressful and difficult for everyone.”

- Lack of core funding

“Will we exist? Our core funding might disappear as budgets in public sector are tightened.”

“The greatest challenge is securing core funding over long enough periods to plan and achieve this.”

“Core funding continues to be a huge problem. We have to be ablen to work from a stable core position. Too few funders want to find core - this leaves very good voluntary organisations vulnerable to public sector cuts. We spend half our lives seeking funding from multiple sources which makes everything so much more time consuming”

- Challenges for small charities / rural organisations

“It is particularly difficult for micro charities to survive, especially in remote rural areas - difficult to get funding due to the amount being "spread over small numbers of inhabitants". I'd like to see funders and government (local and Scottish) take more account of the fact that these areas are deprived of services (in recent years) that other places take for granted. This should be given due consideration by funding bodies.”

“We know that some smaller organisations have lost funding and had to pay off staff. These numbers seem small at a local level, but collectively I suspect this number could be significant at a national level.”

- Competition

“Challenge - Money & competition from other local providers with whom we are forced to compete for scarce resources instead of cooperating to deliver the best joint support to clients”

“(needless) Competitive tendering remains an expensive resource and a needless risk, especially when the evidence demonstrates that collaboration leads to more positive outcomes for stakeholders.”

- Survival

“Accessing funding before the organisation has to be closed.”

- Sustainability

“Sustainability and the future funding landscape which has become increasingly competitive. Far harder to access and gain funding awards particularly over more than one year than say four years ago. Often the amounts needed are not large, we are expert at making a little do a very long way, but still a much greater challenge than before.”

- Public sector/ local authority cuts

“One key challenge is that funding from the Scottish Government and Local Authorities is still being allocated on a stand still budget basis and so staff have not had any pay increase for around eight years.”

“[A key challenge is] retaining services through tendering whilst commissioners are looking to reduce expenditure.”

As well as the direct impact of cuts to third sector organisations, a number of respondents were concerned that cuts would have a knock-on effect, resulting in an increase in pressure on the third sector, and more people requiring support:

“If local government pots shrink any more, there will be significant challenges for the sector in trying to 'take up the slack' as local government pulls out of many roles, especially those that are not statutory”

“Ever reducing services as Local Authorities continue to make cuts to services which prevent people getting into crisis.”

“Funding cuts are going to continue to be an issue while they are happening as they hit the third sector across the board and when statutory services are also cut this also impacts on the third sector as the demand for our services increase while people wait for mental health support or other specific support.”

“How the funding cuts impact on their adults and young people involved in the services we run.”

- Poverty

A number of respondents were concerned about poverty, along with more specific challenges around unemployment, benefits, and homelessness:

“Increasing poverty among children and families; impact of cuts in children's services budgets. Zero growth in the economy.”

“Also the impact of austerity on the people we work with and its knock on effect on staff.”

“Maintaining/increasing self-generated income given that we are serving poor people in an impoverished area.”

- Demand

“Meeting demand on the same budget”

“Coping with demand.”

“Growing demand”

“Meeting demand for counselling, mental health support.”

“Demands of ageing population”

- Public Sector relationships / recognition of the value of the third sector

“Getting local authority to realise that we provide a service to them and therefore giving us a grant is not charity but an investment. They seem to tolerate and pay lip service to Third Sector involvement instead of fully involving us as part of the solution.”

““The challenges all lie around an uncertain financial future and a drive on behalf of commissioners towards consortia. At the moment commissioners are not considering the development of partnerships from the perspective of ethos and values or financial resilience for example.”

“Big challenge is for the 3rd sector to have parity of esteem and influence with public sector, locally and nationally.”

“The Scottish Govt need to do more to ensure the 3rd Sector are equal partners at the table, rather than at the mercy of Health and Council.”

- Health and social care / lack of investment in prevention

“Lack of coherent approach to social care delivery in Scotland, disconnect between Scottish Government and local authorities and total lack of preventative spend and approaches.”

“Biggest challenge is volatility of health and social care partnerships and their slash and burn approach.”

“As social work continues to be under siege and public health increasingly comes into focus, the third sector will be asked even more to support those at the severe and complex end of service delivery. For many, this is not where we are best able to make a difference and we risk failing those who are just struggling to cope”

“Embedded, ie not short term, investment in community led approaches to health and wellbeing improvement across Scotland”

- Uncertainty / inability to plan for long term

“I put "sourcing long term funding" as a secondary challenge but that just isn't going to happen and we are resigned to it. So the main issue is - as ever - balancing the immediate demand and delivery needs with trying to plan longer term when we have no idea what funding if any we will have beyond 12 months. This is true for most people in the sector in my experience so we are not alone.”

“Difficult to know how economy will develop and any knock on effect on communities we work in.... will demand increase or not?”

- Staffing and pay

Recruiting and retaining skilled staff is a challenge for many responding organisations, particularly when pay levels are not increasing for most staff:

“Securing sustainable funding arrangements, paying above the Scottish Living Wage, reducing agency, retaining skilled staff, maintaining our reputation as a high quality provider”

“Sustaining a highly skilled workforce and competing in terms of recruitment, retention etc”

“Big challenge for the organisation is attracting and retaining skilled staff and board members which ensure we have the capacity to deliver high quality services.”

“Merger with another organisation. Keeping staff after a salary review and over 60% were unhappy. Staff who have been with the organisation for years and never on a salary grade were put on a scale but at bottom. Number of staff said sector does not care about no salary increase in years but double work.”

“Pay and reward - it’s dreadful, so many low paid staff and no signs of improvement”

“Recruitment and retention as the rise in the Living Wage devalues our posts relative to minimum level ones.”

“Work loads have increased but not pay so staff are now looking else where. Losing qualified staff will damage sector going forward”

“Increases in living wage narrowing the differential between support staff and senior support workers, putting financial pressure on organisation to fund an increase in senior and management salary without financial support.”

“Uncertainty about staffing levels and rates of pay as a good number of staff and volunteers are EU nationals”

“Stress and mental health of staff- particularly front line workers working with increased need and vulnerabilities and the ability of grassroots organisations to respond to this properly.”

Opportunities

| Table 2: Opportunities cited | Count of OPPORTUNITIES |

| Reputation and reach | 14 |

| need/ high demand | 13 |

| Policy developments | 10 |

| Partnerships and collaboration | 8 |

| Innovation and new opportunities | 7 |

| Value of sector | 6 |

| Growth | 5 |

| Technology/ digital | 4 |

| Young people | 3 |

| Enterprise | 3 |

| premises | 3 |

| Mental health | 2 |

| Expansion | 2 |

| Diversification | 2 |

| Procurement | 2 |

- High demand / need for services

As well as the challenges that come with increased demand, many respondents highlighted positive opportunities that come with demand – being able to show that their services are vital, and trying to work creatively to meet high demand and deliver quality services to their beneficiaries:

“The need for our programme is high but the capacity to meet demand is a challenge. Need to build a more sustainable funding base and partners to help us with this transition.”

“With increased demand for services comes opportunities for creative ways of working.”

“Creating our own income stream to fund the services we know are needed to the people that need them. Young homeless people deserve to be loved and have fun, we’re funded to house them and not much more. We can do better than that.”

“Opportunity to maximise growth potential through need/demand for our family support and money advice services and our ability to demonstrate value for money. At the moment the challenges are outweighing any opportunities for developing a sustainable business model.”

- Reputation and reach

Respondents also highlighted a number of opportunities in terms of increasing public awareness of their services, and raising their reputation/ profile with funders by improving how they demonstrate the impact and effectiveness of their work:

“Opportunities for us are around the recognition of the effectiveness of the services we provide as demonstrated by robust evaluation”

“lots of scope to improve our quality, customer focus and innovation”

“Reaching families who need support but who have not come forward before (an opportunity and a challenge).”

“We are punching well above our weight, which is exponentially increasing our profile and reputation and the trust that our stakeholders have in us. We remain very optimistic about new opportunities opening up, albeit in a climate of continuing uncertainty and financial challenge.”

Also scope to improve communications with the general public:

“I don't feel the public really has a good understanding of the voluntary/charity sector, the scale of the organisations or the range of work carried out.”

- Value of sector / recognition of impact

Closely linked to above, respondents felt that there were opportunities around conveying the importance of the sector’s contribution and recognition of the need to invest in them longer term.

“Overcoming the barriers and silo mentality. Getting sustainable long term funding and investment and recognition that third sector are valuable and contribute to the economy”

“Funding for the long term as there is little understanding of the important role we provide for older carers.”

“The emerging realisation that the NHS will need the efforts of the third sector to deliver effectively in the future”

“Ensuring that the voluntary youth sector is recognised as an equal partner in delivering services in a vast rural area which is currently served by a large ALEO. Developing a stronger relationship with local decision makers.”

- Policy priority areas /strategies

Key policy areas mentioned by respondents include:

- Health and prevention

- Self-directed support

- Mental health

- Young people / youth work

- Children and families

- Carers

- Community empowerment

- Inclusive Growth

- National performance framework priorities

“We hope that the rise in awareness around social isolation and loneliness and the forth coming strategy due out soon will provide increased awareness and new opportunities.”

“Positives: strong, supportive Equally Safe strategy, accompanied by financial support for the third sector; strong local confidence in the service provided to survivors of sexual violence.”

“We work in mental health which is an area receiving increasing attention. The challenge is that monies allocated by Government given to the NHS who are not always best placed to spend it effectively and get value for money.”

“Utilising the community Empowerment act to enable our members to take ownership of assets and services in their local communities”

“Opportunity - greater alignment with national policy priorities”

“Policy focus on our services and sphere of influence”

- Collaboration and partnerships

Collaboration with other third sector bodies, and also with the public, private and academic sectors:

“Opportunities come from positive relationships with Scottish Government and lots of great partnerships with other third sector organizations.”

“Opportunities to work more closely with partners through local networks, sharing resources.”

“Relationship between third sector bodies are tricky. We need better collaboration to make it all work. We have to adapt to survive and there is often a sense I get that it’s everyone else’s fault. But the only way out is to work together.”

“The sector needs to come together and talk about the future. We are all doing more for local authorities and government but get very little back.”

“Big opportunity for the sector to collaborate with FE and HE institutions and across the 3rd sector to further influence and develop policy.”

“Developing our work with businesses and our work to help people transitioning into employment.”

“Linking with education Scotland and other national stakeholders to evidence the impact of voluntary sector organisations on young people's wellbeing.”

- Digital/ technology

“Using technology - to reduce costs, increase transparency, increase efficiency, reduce duplication internally and with partners.”

“the market is increasingly looking for digital solutions and this is one of our main work streams in our new strategy.”

- Growth

“Opportunities to grow and develop service provision, to more people and across a wider geographical area.”

“Opportunity to increase range of options available to service users.”

“[Opportunity] to procure larger, more up to date, premises in order to cater for our expanding membership and which in turn will also enable a wider range of activities and services to be carried out.”

“Opportunities to grow and develop service provision, to more people and across a wider geographical area. Opportunities to diversify income streams.”

- New funding models / enterprise/ sustainable funding

“Opportunity - earning income by sharing expertise (if we can persuade people to pay)”

“Opportunity to maximise income generation although is a much more competitive market - coming from both private and voluntary sector”

“The opportunities are boundless if we can secure funding. This is the exactly same for challenges.”

“Develop a more private sector approach through setting up social enterprise models as not much point relying on public sector income any more.”

“moving from grant income towards becoming sustainable from people paying for our services”

- Innovation and creativity

“Developing new innovative services”

“We will continue to embed our programme of values led, relationship based resilience for the whole organisation, investing in staff and volunteers capacity for innovative thinking, continuing to devolve decision-making to the front line and increasing the influence of those we journey with.”

“We are supporting some of our services to be set up as a separate SCIO which will be challenging but provide much more scope for development and influencing service design”

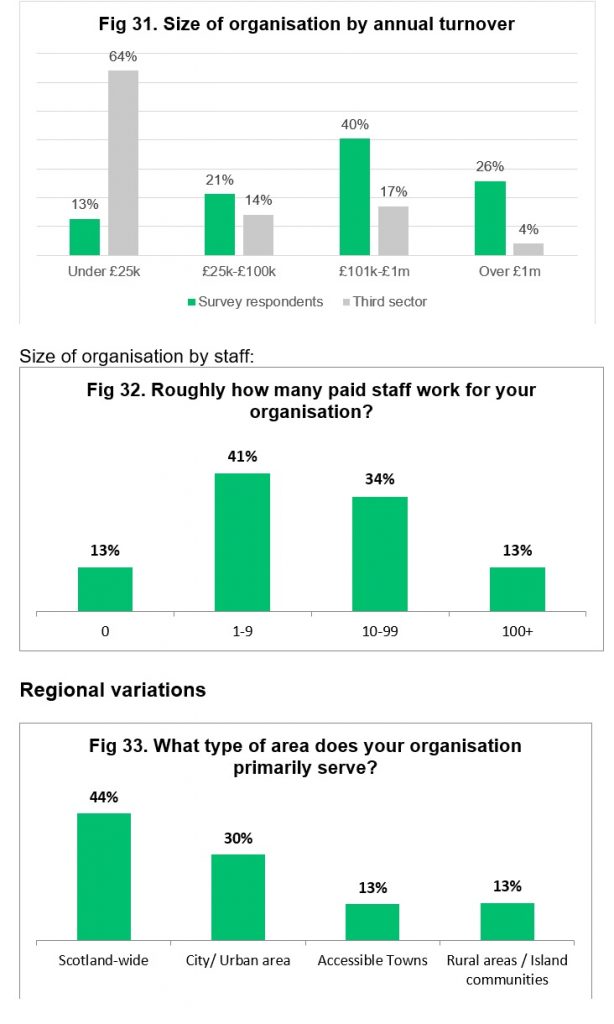

11. Respondent profiles

Size of organisation by annual turnover: Good mix of organisations by size, although profile is skewed towards larger organisations.

Regional variations